The EIAC standard provides efficiency and optimizes the implementation of connectivity processes between insurers and brokers.

The implementation of a standard that normalizes the exchange of information between brokers and insurers is an old and important sector aspiration. We have always expressed ourselves in this sense and we have been consistent with it, committing our contribution to this challenge that began to take shape in 2005 through the then SIAC project, led by TIREA, in which ebroker participates actively and in which derives from our current SIAREC two-way receipt exchange system.

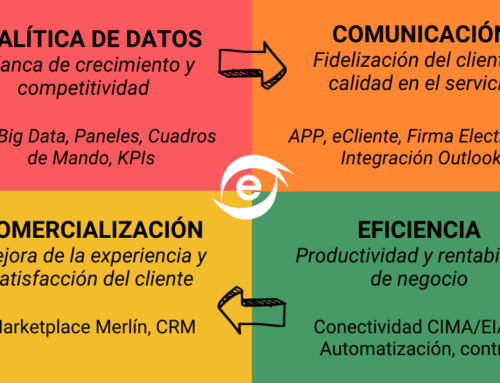

Today EIAC represents the materialization and consolidation of a sector challenge of high strategic value. The EIAC standard provides efficiency and optimizes the implementation of connectivity processes between insurers and brokers. The connectivity It brings efficiency to the corridor as it contributes decisively to the reduction of the administrative burden. The broker benefits from EIAC because as a standard it favors the development of more and better connectivity functionalities.

Now EIAC is no longer an aspiration, it is a reality and we all have an important responsibility to spread it, implement it, evolve it and make it sustainable over time. The new steps must go in the direction of concretion, refining what has already been achieved in the developed phases. It is preferable to give priority to securing, rather than establishing scope of a new nature.

That said, it is also good to think about the evolution of EIAC, even reflecting on the definition of the standard itself in view of the first experiences in its implementation that have revealed some difficulties that must be overcome, especially those that have been derived from what we have coined as "data quality" and that make inefficient implementation by technology companies, due to the excessive flexibility of the product standard of the need to reconcile the interests of different and multiple insurers in the transition of adaptation of old formats to EIAC. We must not renounce to move forward limiting / limiting the flexibility of the standard since it is reasonable that it should evolve beyond the limits initially defined. It is necessary that EIAC be a more standard standard.

Going to search or manipulate data files of policies, receipts, claims, with or without standard, is not efficient and increases the administrative burden. You have to automate the processes. The data structures from insurers have to be

necessarily operated (establishing a transition) by Web Services to be automatically integrated with the management systems and be subject to basic business rules regarding delivery / availability deadlines in certain areas (portfolio receipts, new production, etc.)

We should also take steps so that the scope applies to the scope of guarantees / coverage and standardize its use for the auto branch, as it is the one that is technically most feasible and the one that represents the greatest weight over the portfolio volume of the average broker. Strategically advancing in this sense is essential if we wish to meet the expectations of the brokers of bringing EIAC to multitarification processes in the near future.

Disseminate, implement, consolidate and advance in a sustainable manner should be the focus for the next steps.

EIAC is here and it's here to stay.

ebroker CEO